Download Bank of Maharashtra RTGS NEFT Form PDF: Hi, my dear readers. How are you all doing? I hope you’re doing well and making progress in your lives. Did you know that RTGS and NEFT are electronic payment gateways used by banks to make transactions more secure? RTGS stands for Real Time Gross Settlement. NEFT financial transactions are done in batches. RTGS is an abbreviation for Real Time Gross Settlement. NEFT is an abbreviation for National Electronic Fund Transfer System. For electronic transactions, RTGS and NEFT are more dependable and secure payment electronic transactions.

BOM RTGS Form Pdf

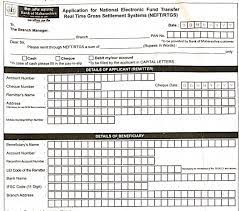

At the same time, I’d like to inform you that the originating and destination bank branches are both part of Chalu’s RTGS network. Beneficiary information such as beneficiary name, account number and account type, beneficiary bank branch name and IFSC should be provided to the remitter in RTGS and NEFT.

Bank of Maharashtra NEFT Form PDF 2024 Download

Bank of Maharashtra RTGS/NEFT Form PDF 2024 Download

Bank Of Maharashtra (BOM) provides personal banking services such as accounts, fixed deposits, loans, gift cards, and credit cards. Also involved in the NRI, Agricultural, and Corporate Banking sectors.

Important Link for Bank of Maharashtra RTGS NEFT Form Download, If you need a copy of the Bank of Maharashtra RTGS NEFT Form, click one of the links below. To do RTGS at the Bank of Maharashtra, utilise the BOM Bank RTGS form. More than Rs 2 lakh can be sent using RTGS to any bank account. NEFT transactions at banks are carried out using the Bank of Maharashtra Bank NEFT Form. The Bank of Maharashtra does not have a minimum transaction threshold for NEFT.

Take close attention: After downloading the form, print it out. If you want to know how to fill it out, you may read this post all the way to the end.

How to Fill Up a PDF RTGS and NEFT Form for the Bank of Maharashtra? Keep in mind that RTGS is only utilised for payments of more than Rs 2 lakh. NEFT is utilised for payments under Rs. 2 lakh. The steps to fill out RTGS and NEFT forms are as follows: –

- Amount to be transferred: Enter the precise amount that needs to be taken out of your account.

- To be debited account number: Your Bank of Maharashtra account number, which will be used to debit the transaction amount.

- Name of the Beneficiary Bank and Branch: The beneficiary of your transaction and the beneficiary branch code should be clearly written.

- The receiving branch’s IFSC code is: With RTGS and NEFT, the IFSC code is significant. Please fill out the form.

- Customer Beneficiary Name: Without making any mistakes, write the customer’s name.

- Customer Beneficiary Account Number: Never make a mistake while writing the account number; be careful.

- sender of any necessary information to the receiver. It is deductible for tax purposes.

Summary: Download the Bank of Maharashtra RTGS NEFT Form PDF.

Dear readers, I really hope that downloading this Bank of Maharashtra Bank Rtgs NEFT Form PDF went without any issues. You may also get the form from the official website if you haven’t already. In the beginning of the article, I provided a link to the official website.